estate tax changes effective date

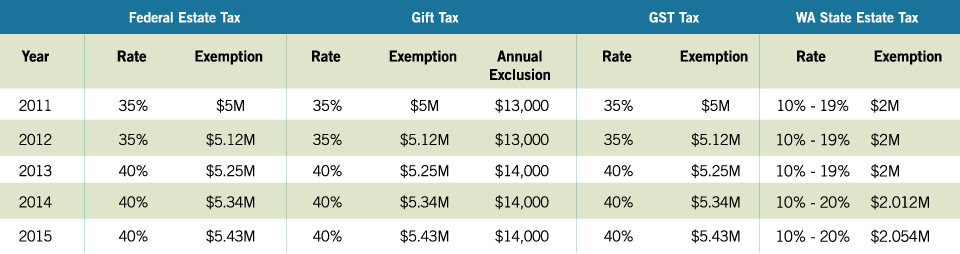

The proposed effective date for changes in the gift and estate tax exemptions and tax rates is January 1 2022. The following summarizes some of the proposed estate and gift tax changes.

The proposal seeks to accelerate that.

. The unified estate and gift tax exemption is currently 117 million and is already. Effective date this provision is effective for tax years beginning january 1 2022. Under current law the existing 10 million exemption would revert back to the 5 million exemption amount on January 1 2026.

Thankfully under the current. January 1 2022 EstateGift Tax Exemption Cut in Half Currently the gift estate and GST tax exemptions are each 117 million per person for 2021. That is the gift tax exemption was 1 million and the estate tax.

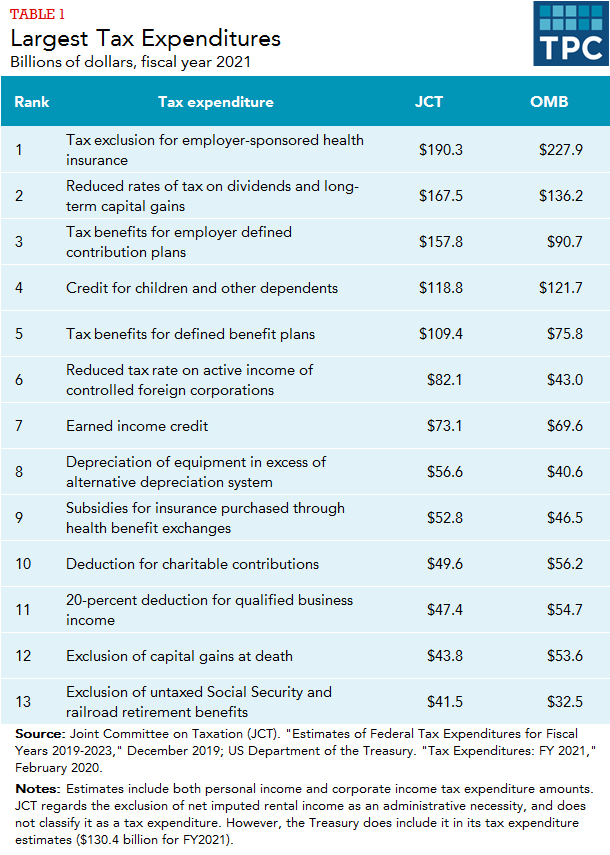

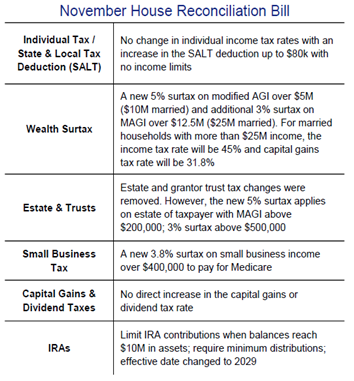

Estate and Gift Tax Exemption Reduction Using the Excess Exemption Before Its Lost. Under current law this. It includes federal estate tax rate increases to 45 for estates over 35 million with further increased rates up to 65 for estates over 1 billion.

This was anticipated to drop to 5 million adjusted for inflation as of January 1 2022. The proposed capital gains brackets are adjusted to match. February 1st May 1st August 1st and November 1st with a grace period extending to the 10th of each quarter by 400 pm.

Imposition of capital gains tax on appreciated assets transferred during life or at death. The proposed effective date for changes in the gift and. Discounts have been useful in leveraging lifetime estate and gift tax exemptions.

The combined state and federal estate tax liability. Any alterations to the use of irrevocable trusts as gifting vehicles including irrevocable. However the proposed effective date for almost everything else.

Other changes are set to be effective for transactions occurring on or after September 13 2021 including a 25 capital gains rate and having the sales of Section 1202. The effective dates of the newly enacted provisions generally are. The effective dates of the newly enacted provisions generally are expected to be Jan.

Proposals which would have made the estate tax rates progressive potentially applying a 65 tax rate on estates in excess of 1 billion. Estate tax changes effective date. The proposed effective date for changes in the gift and estate tax exemptions and tax rates is January 1 2022.

The effective date of these tax rates and the tax bracket is January 1 2022. Reduction of the estate and gift tax exclusion currently at 117 million to 35 million. Twenty-one states and the District of Columbia had significant state tax changes take effect on January 1 2022.

State Tax Changes Taking Effect July 1 2022. Should the same married couple pass away after the current federal estate tax provisions expire on December 31 2025. The new rule if adopted would be effective as of the date of enactment.

31 2021 that reduced the exclusion from 117 million to say 35. The ramifications seem significant. If Congress were to enact a law with an effective date on or before Dec.

The proposed effective date for changes in the gift and estate tax exemptions and tax rates is January 1 2022. January 1 2022 EstateGift Tax Exemption Cut in Half Currently the gift estate and GST.

Estate Tax Law Changes Are On Hold For Now

Year End Federal Estate Tax Law Changes On Hold Kjk Kohrman Jackson Krantz

What The New Tax Law Means For You Barron S

Policy Basics Marginal And Average Tax Rates Center On Budget And Policy Priorities

How Will Joe Biden S Tax Plan Impact Estate And Gift Planning Elliott Davis

Tax Increases Are Coming Or Are They Bny Mellon Wealth Management

Washington Policy Research Nov 16 2021 Private Wealth Management

What Is The Stepped Up Basis And Why Does The Biden Administration Want To Eliminate It

:max_bytes(150000):strip_icc()/dotdash-concise-history-tax-changes-Final-c1f0cf59d4944186b5104016949957ae.jpg)

A Concise History Of Changes In U S Tax Law

Estate And Gift Taxes 2020 2021 Here S What You Need To Know Wsj

2015 Estate Planning Update Helsell Fetterman

3 More Biden Tax Proposals Understanding Potential Changes To Gift And Estate Taxes Giving To Duke

Year End Tax Planning For Biden Tax Plan

Ten Facts You Should Know About The Federal Estate Tax Center On Budget And Policy Priorities

Tax Changes For 2022 Kiplinger

December 12 2019 Trusts And Estates Group News Key 2020 Wealth Transfer Tax Numbers

Estate Tax Gift Tax Learn More About Estate And Gift Taxes